What are the elements of a supply side policy?

Part1

Hector McNeill1

SEEL

| This article is a revised and updated version of one originally posted in 2000. Updated: March, 2020 |

This revision and update replaces an older article. This article explains why what is often referred to as supply side economics is in reality a fiscal variant on ADM policies such as Keynesianism and monetarism. All of these theories and policy propositions are devoid of a microeconomic foundation leading to various levels of difficulty imposed by these "one-size fits all" centralized policies in the form of imposed interest rates, taxation, accountancy rules and expansion of money through debt, as opposed to savings leading to lack of traction and a cyclic unstable nature of outcomes.

The real incomes approach provides a microeconomic foundation for the macroeconomic policy framework that provides incentives for companies to adapt their performance to their specific conditions. By establishing Rio-Real incomes objective for both companies and a policy with incentives and transparent business rules on how to maximize performance and competitive advantage, the Real Incomes Approach can achieve sustained traction and real economic growth ( See: Why Real Incomes? ).

In this first part of an expanded two-part article the initial rationale for the development of this approach is outlined relating to the case of slumpflation.

Part 2 will cover how this approach provides policy objectives and instruments to manage the economy, in any condition, so as to lower the probability of the types of major economic crises experienced during the last 90 years. |

|

What is referred to as supply side economicsWhat is referred to as supply side economics emerged during the late 1970s as a solution to slumpflation (the combination of high inflation with high unemployment). This solution, in spite of its name, is a top down mechanism that reduces marginal taxation of companies as well as top tax payers under the assumption that by reducing top rates the funds released will flow into productivity-enhancing investments leading to lower unit prices and thereby reduce inflation. This has a loose logic in the sense that it is logical but in practice does not work. What happened in practice was that in the case of many companies, top executives shared the benefits with shareholders as bonuses and dividend payments. This improved the earnings to price ratios of shares but did little to improve productivity or reduce inflation on the basis intended. As a result supply side economics is essentially a fiscal system which relied on the Aggregate Demand Model (ADM) used by Keynesians and monetarists. To be fair, supply side economics did, in the case of some companies, lead to higher productivity investments but overall, as in the case of all ADM-based policies this approach lacked traction and generated winners (those who pocketed the benefits) and losers such as wage earners.

Does that mean supply side is the wrong focus for policy?

As will be explained in this article, supply side is indeed the correct focus of policy for all circumstances but the appropriate supply side model is different from that which has emerged with the title of "supply side economics".

Work on the Real Incomes approach was initiated in 1975 to address the same issue as what turned out to be supply side economics, slumpflation. However, the Real Incomes approach ended up as a supply side solution whereas so-called supply side economics ended up as a variant of ADM-based policies.

The reason for this significant difference in "solutions" arose was because the real incomes approach was also initiated by another reason. Neither Keynesianism nor monetarism possessed policy instruments to solve the slumpflation crisis without imposing severe prejudice on the social and economic constituencies; usually intensifying disparities in income and wealth. It was therefore self-evident that the fundamental premises based on the ADM were unacceptable. So a solution could only be found by analyzing why the ADM fails in practice and then to detect where the theory is flawed. Therefore the first focus was to start with a clean sheet and to review the fundamental causes of inflation in order to identify, at least for this particular set of conditions, a policy solution.

What causes inflation?

The knee-jerk explanation as to the cause of inflation was, and remains, "Demand". However, the slumpflation crisis was caused by a massive price increase in an essential economic input, petroleum and petroleum derivatives (PPD). Consumption was drastically reduced because normal users lacked sufficient funds to afford PPDs at the prevailing and rising prices.

As a result their consumption fell because of insufficient purchasing power.

Price setting

The need for PPDs remained high but this "demand" made no difference to this kind of inflation. The only way companies could continue in business was to substitute or change technologies and techniques of how they used PPDs to produce their products and services.Where it all began

The work leading to the Real Incomes Approach started in Rio de Janeiro, Brazil in 1975. Initially focusing on the impact of the petroleum crisis on the Brazilian economy. Some of this initial work made use of the resources provided by the Getulio Vargas Foundation located in Botafogo, Rio de Janeiro.

The Real Incomes theory and policy propositions emerging from this work have since become a new front in macroeconomic policy analysis, constitutional and development economics.

|

|

|

This meant that the cost and price impacts rippled through most supply chains. Therefore the rising inflation, which continued for several years, was the direct result of price setting by companies and had no connection to a mythical "demand".

Risk reduction psychology

Because of the high inflation, a particularly interesting phenomenon occurred in Brazil (see box on left). There, businesses began to adjust their prices upwards on a regular, sometimes daily and real time basis to maintain the real value of their incomes. So what turned into a hyper inflation constantly driving prices upwards, was not demand, but a price setting tactic to reduce the impacts of inflation on company real returns (income, margins, profits). This is a rational decision on the part of managers but it is damaging because it drives inflation on and up. In this cases managers were compounding unit prices as the rate of inflation in order not to discount their real incomes i.e. purchasing power. In much of the media this was interpreted to be irrational or greed and irresponsibility, but it had a logical financial justification. It is therefore not surpirising that Brazil was one of the first countries to introduce monetary correction as a Central Bank policy. However, the price setting was driven by input cost increases and the application of pricing adjustment to compensate for future falls in real income. Demand was not a factor in this process.

Technical options

In extending this analysis to a range of economies and circumstances it became very apparent that the third element is constraints related to the options available to companies to reduce costs through adoption of changes in technology or/and techniques to reduce or reverse unit cost rises to reduce or reverse the rises in prices of output. Again nothing to do with demand.

On this question the monetarist "solution" to inflation is to impose higher interest rates which, of course, discourage investment in productivity and price reducing technologies. In the lead up to an inflation crisis, too much money has been transferred into assets leading to a reduction in the overal levels of investment in more productive technologies. This pattern is a common characteristic of ADM and Quantity Theory of Money (QTM) based policies which are oblivious of the essential need for strategic investment in productivity enhancing technologies at all times.

The technological desert

Analyses by Robert Solow (1957) and Kenneth Arrow (1962) provided copious quantitative evidence to establish that 80% of economic growth is the result of changes in technology, techniques and learning leading to the accumulation of tacit and explicit knowledge, providing the foundations for innovation or beneficial change. Keynes might be excused for not mentioning these realities but Keynesianism and monetarism never adjusted to this important reality. It is notable that if one reviews the content of the main foundation texts of Keynesianism and monetarism or to their policy targets and instruments deployed, including those of supply side economics, there is no mention nor account made to these fundamentally important relationships to economic growth. In short, the theory and the practice takes no account of how the economy works (see pdf: "On the Problem of Technological Ignorance amongst KM Economists" and see also: "Tacit & explicit knowledge"

).

Who is causing inflation?

The rate at which a company passes on inflation is determined by the price performance ratio (PPR). In simple terms this is the percentage change in unit output prices in response to a percentage change in unit input costs. The table below indicates the relationship between PPR and the degree to which a company absorbs or increases inflation.

PPR

Price Performance Ratio | Output inflation rate |

| <1.00 | Inflation rate reduced |

| =1.00 | Inflation rate maintained |

| >1.00 | Inflation rate increased |

For further information: The Price Performance Ratio |

|

|

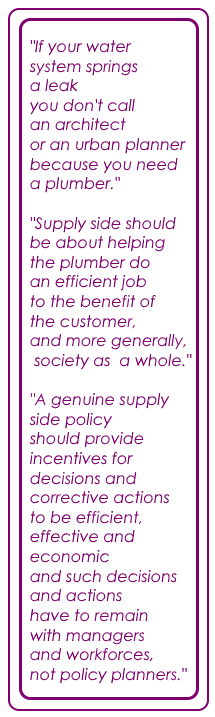

So where does economic growth occur?

Economic growth does not take place in the white space between policy directives and something called "the economy". All change, learning, know how and innovation takes place as a result of incremental and sometimes more impactful decisions taken by those working in the production of goods, services and money. This is, by definition, the supply side. It is the result of such decisions that determine, in aggregate, how the macroeconomy progresses in generating sufficient employment and income in exchange for work inputs so as to maximise the accessibility of output, in terms of information, local delivery and unit prices to satisfy all consumption needs. Therefore a supply side policy needs to be able to provide support and incentives for decision-makers at the microeconomic level to benefit from aligning their objectives to those of a policy with the real incomes objective (Rio).

Price performance ratio

The analysis completed during the development of the Real Incomes Approach revealed that the degree to which a company succeeds in preventing the transfer of input inflation rates to output inflation rates is the price performance ratio (see box on right).

Early conclusions

Three vectors emerged as being of importance to the achievement of an economy equilibrium:

- Real incomes becomes the main indicator of the state of the economy

- Companies require freedom to set prices according to target consumer purchasing power and projected rises in unit costs

- The introduction of appropriate changes to reduce unit costs should be facilitated

|

In terms of policy, subsequent analysis established that by linking policy and microeconomic incentives to the optimization of item 2 (price setting) with the objective of sustaining or increasing 1 (real incomes) companies have a direct incentive to seek to innovate to become more effective in their decision making and operations by identifying the best options from 3 (technology and technique).

Supply side strategy

The the elements listed above are the main focus of any supply side strategy and by following this simple structure companies can balance their operational performance so as to remain price competitive while paying workforces at a level that maintains their purchasing power at an adequate level. Gerald Ford in paying his workers high enough wages so that they could afford to buy the cars they produce is an example of such a rational strategy. This strategy is the foundation of the Real Incomes Approach and the best way to link the components is the Production, Accessibility and Consumption Model (PACM) This has the overall objective of delivering consumption levels that result from unit prices being accessible by the majority as a result of the level of their real income. The Real Incomes approach is designed to minimize inflation which devalues the purchasing power of the currency, thereby enabling people to satisfy their needs for goods, services and money at more stable or even lower prices.

Policy Incentives

ADM top-down policy frameworks consist of interventions through interest rate setting, taxation, accounting regime constraints and monetary expansion based on debt. Because ADM policies have no microeconomic foundations they are incapable of accommodating the vast diversity of environments and heterogeneity of the configurations of operations of the enterprises that make up the population of economic in the economy. The ADM "one-size fits all" approach imposes significant performance constraints whose impact on corporate performance is highly variable. As a result, there are no incentives that assist managers to align corporate interests with those of policy. This invariably leads to inequitable opportunities and outcomes imposed by policy creating a disincentive to respond to aspects of policy by an increasing proportion of the economic constituency. This is why all ADM policies lose traction and take up an unstable cyclical form.

Real incomes policies are the inverse of ADM-based policies in providing a microeconomic foundation to the macroeconomic policy framework. The policies are based on making the Real Incomes Objective (RIO) the policy and corporate objective while permitting companies to achieve this objective according to the specific conditions of each company. Traction is secured by placing into the hands of management decision-makers the ability to manipulate the policy instruments to support what is feasible with respect to the constraints facing each company.

Policy instruments

There are two basic policy instruments in the RIO toolkit.

- Price Performance Ratio setting

- Price Performance levy setting

|

The price performance ratio (PPR) is established by decisions at corporate level to attempt to minimize its value to unity (= 1.00) and to less than unity (< 1.00) according to the operational unit costs and unit output prices. Sometimes this is simply a price setting issue to lower unit prices and secure a faster market penetration. However, frequently it is necessary to raise unit costs endogenously in order to introduce a technological improvement. If this change results in higher productivity, then it is possible to lower the rate of unit price increases so as to lower the PPR.

Price Performance Levy

The price performance levy (PPL) is the incentive instrument which is a withholding levy that is set, according to the economic conditions to a basic level and at a level companies would wish to avoid, say 30% (For further information: The Price Performance Levy ). This means that companies achieving a PPR of 1.00 will have 30% of their margin reduced through imposition of the Levy. However, the Levy operates according to formulae that provide a reduction in the levy according to the degree a company reduces the PPR below 1.00. Thus fairly small reductions in the PPR can be associated with significant levy reductions and it is possible for managers to reduce PPR to a point that no levy is paid at all. Companies that are making no effort to perform in terms of PPR by permitting them to rise above unity (> 1.00) pay increasing marginal surcharges.

The PPL is not a tax, it is an instrument designed to provide incentive for companies to improve their competitivity in a way that increases their real incomes as well as real incomes of consumers.

Business Rules and the Policy Administrative Framework

Such a policy requires transparent business rules to guide managers on the principles of decision analysis that helps them maximize their competitive position while minimizing risk. Business rules are required because real incomes would be assessed according to changed pricing optimization algorithms.

This article has painted a broad brush outline of some of the principles and ideas concerning instruments that can support a supply side approach with the real incomes objective. What has not been covered is the required policy administrative framework required to gain oversight and coordination of such a macroeconomic policy environment. These include such things as the place of government revenue-seeking (taxation), the accounting structure required for this to operate, the oversight of company PPR and PPL estimates, monitoring of performance and the mechanisms that need to be used to safeguard the system and society against fraud and criminal behaviour. These topics are covered in some articles on this site and a more comprehensive treatment is in preparation.

Part 2 of this article, a new featured added with this revision and update, will explain how this form of supply side economics, which sustains a real incomes objective, is a less risky basis for managing the economy in a way that secures faster and more stable real economic growth while lowering the risk of the development of the types of conditions that led to major economic crises.

The potential outcomes of this approach to supply side economics is a better distribution of a higher level of real income as shown in the simulations of an early Real Incomes model shown below:

1 Hector McNeill is the director of SEEL-Systems Engineering Economics Lab.

|

|

All content on this site is subject to Copyright

All Copyright is held by © Hector Wetherell McNeill (1975-2020) unless otherwise indicated

|