The price elasticity of consumption (pEc) is the percentage increase in consumption of a product or service associated with a percentage reduction in unit price. It is similar to the price elasticity of demand but the word "consumption" is used to align the concept with the Production, Accessibility & Consumption Model (PACM) which is a supply side representation of the sources of growth in the economy. This is distinct from conventional theories (Keynesianism, monetarism and supply side economics2) and their derived policies that presume that growth originates in demand as set out in the Aggregate Demand Model (ADM).

Conventional theories and policies and the ADM are at variance with the fundamental truth that the source of 60% of economic growth is learning, advances in technology and technique, the accumulation of tacit knowledge through experience as well as the accumulation of explicit knowledge and the application of these resources in designing and bringing about innovation. Innovation makes possible the production of more sophisticated products and services as well as traditional products and services that combine a higher quality with lower unit prices. Innovation, in terms of allocative decisions, is determined by supply side decisions. The price reduction effects of innovation have an impact on the currency value by increasing its purchasing power and helping disseminate higher real incomes throughout the economy even when nominal incomes have not changed.

Knowledge of the ranges of price elasticities of consumption of products and services is fundamental to the identification of opportunities to achieve market penetration and generate higher corporate revenues and the payment of higher incomes to those working for a company. The simple process of penetrating markets on the basis of lower unit prices results in the increased distribution of growth in real incomes as a result of the income effect of lower prices on nominal incomes. This has the effect of disseminating real growth throughout the economy.

The significance of price elasticity of consumption

The PAC Model of the economy (see "The PAC Model of the Economy") provides an analytical basis upon which embody well-established economic relationships such as the marginal propensity to consume (MPC). This is defined as the increase in consumption arising from an increase in disposable income. For example, if a household earns one extra £100 of disposable income, and the marginal propensity to consume is 0.80, then of that £100, the household will spend £80 and it is assumed, save £20. This assumes that the household cannot spend more than the extra £ without borrowing money.

The general formula is:

MPC = ΔC

ΔYwhere:

MPC is the marginal propensity to consume

ΔC is the increase in consumption

ΔY is the increase in disposable income.

Under the PAC Model of the economy and the Real Incomes Approach, in particular, the increase in disposable income ΔY is the increase in real income ΔrY. The increase in real income is proportional to the purchasing response to unit price falls and therefore it is proportional to the price elasticity of consumption. Therefore, the marginal increase in purchasing power associated with a marginal unit price decline represents a marginal increase in real income, including real disposable income that is strictly related to unit price movements. In effect the increment in real incomes ΔrY in response to unit price variations which can therefore be expressed as a price elasticity of income (pEy) which is equivalent to the pEc.

Therefore:

ΔrY=pEyTherefore the marginal propensity to consume relationship can be rewritten as:

MPC=pEywhere:

MPC is the marginal propensity to consume

pEy is the price elasticity of income

pEy = pEc

In summary the

price elasticity of consumption =

price elasticity of income =

marginal propensity to consume

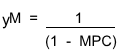

The Income Multiplier (yM)The multiplier effect is the impact of the marginal propensity to consume on a chain of consumers who happen to receive their incomes from a chain of enterprises. There is a general formula that estimates the total additional expenditure or income arising from an initial expenditure. This the multiplier is given by the following formula:

Where:

yM is the multiplier (the number of times an initial outlay expands with consumption cycles)

MPC is the marginal propensity to consume

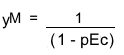

The Real Income Multiplier (RyM)

By substituting the MPC by pEc, the formula becomes a Real Incomes Multiplier:

Therefore, the marginal propensity to consume changes in character from being simply a quantiative measure of the rise in consumption associated with income to a measure of the rise in real income (purchasing power) associated with a reduction in unit prices. This has the result of giving a quantiative means of measuring the dynamics of real incomes in relation to unit prices.

Orders of magnitudeThe actual significance of the impulse in real incomes growth through the Real income Multiplier depends upon the distribution of unit price declines amongst the different components of consumption. Therefore if 10% of consumer items and services benefit from a 10% drop in unit prices and the price elasticity of consumption is 0.5, the macroeconomic real incomes impulse will be equivalent to just 0.05 of the current real income of the entire economy generating a multiplier of 1.05. If on the other hand there is a generalized fall in unit prices of 10% affecting some 90% of consumption items, then the impulse in real incomes will be equivalent to 0.45%, generating a multiplier of 1.82.

The PAC Model of the economy takes into account the fact that consumption depends upon the critical variable of accessibility of products and services in terms of:

- accessibility to information concerning products and services through the dissemination of information are building up awareness amongst potential consumers

- accessibility of unit prices of products and services in relation to real disposable incomes

- accessibility to the products and services in terms of physical delivery and support and maintenance

These items involve dissemination over geographic space involving physical logistics as well as data and information infrastructures all of which involves time delays. Therefore an important aspect of calculating the rates of real incomes growth arising unit price falls and the multiplier effect needs to take into account the overall price effect across all products and services and the time delays involved for the dissemination of the products and service "take up" amongst consumers. Thus the example given above where a generalized fall in unit prices of 10% affecting some 90% of consumption items and a multiplier of 1.82 . Even if this multiplier was realized over a period of 10 years this would represent an annual growth rate of in excess of 5.75%/annum.

An exampleThe most stiking example of this effect has been the case of consumer electronicsin tha last 30 years where unit prices have constantly declined and real consumption has risen through the augmentation in purchasing power resulting from the unit price declines. This capability is a direct function of technological and technique innovation in the fields of manufacture and applications.

The significance of this relationship is that real economic growth can be recognized to be generated from supply side actions related to unit price-setting decisions at the level of the economic unit. For further information on the income multiplier effects under the PAC Model see

The Real Growth Multiplier

Business rules Under Price Performance Policy the objective is to support the Real Incomes Approach's aim to secure a positive systemic consistency (See:

Positive systemic consistency) by aligning micreoconomic and macroeconomic objectives. This is achieved through specific business rules that take advantage of the relationships described in this article (See:

Appropriate business rules for competitivity & growth).

1 Hector McNeill is director of SEEL-Systems Engineering Economics Lab.

2 The theory and practice of supply side economics is in reality a variant in fiscal policy and as with Keynesianism and monetarism it is undermined by the profit paradox.

Original posting: 2015;

Updated: 19 June, 2020;

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2015) unless otherwise indicated