Slide sequence

This article is available as an online slide sequence for teaching purposes. Access to the notes will be posted on the Boolean Library as well as on this site. |

|

|

The Quantity Theory of Money (QTM) This article explains why the Quantity Theory of Money (QTM) is quite useless as an identity to explain the relationship between money volumes and average prices.

As is well known, the most widely used version of the QTM was developed by Irving Fisher and it is as follows:

M.V = P.Y Where:

| M is the volume of money in circulation; | V is the velocity of money; |

| P is the average price of goods and services; | Y is the real income used in transactions. |

As can be seen this identity suggests that a rise in M can be associated with a rise in prices (P) associated with a fall in real income (Y) or a fall in unit prices (P) and a rise in real incomes (Y) or a rise in both P and Y.

Three assertionsThere are three common statements, based on the QTM, which are asserted by monetarists, usually with no accompanying evidence:

- An assumption that injecting more money (M) into the economy, demand is raised leading to more economic growth.

On the question of economic growth Nicholas Kaldor explained that economic growth comes from the natural demand of supply side production enterprises for investment funds. So the assumption that demand is generated by monetary injections inverts the actual logical sequences of the origins of economic growth1.

Such supply side demand for funds tends to go into productivity-enhancing investment and therefore tends to generate counter-inflationary growth.

1 Kaldor, N., "The new monetarism", Lloyds Bank Review, 1970. |

- M can increase to high levels which can result in general price rises in goods and services, or inflation

On the question of "excess" M generating inflation, monetarists, such as Milton Friedman, who held this opinion, were unable to explain the mechanism whereby money volumes generate inflation because in a competitive economy prices are set by companies who have no reason to raise prices since this loses market share2.

2 McNeill, H. W., "Monetarism & The Cost of Living, British Strategic Review, 2022. |

- That by restricting M through raised interest rates or taxation, inflation will decline and the economy will return to a "natural equilibrium"

On the question of restrictions in M there are no known mechanisms apparent in the QTM to return the economy to a "natural equilibrium"3.

3 Neild, R.,"The 1981 statement by 364 economists" in "Expansionary Fiscal Contraction", CUP, 2014. |

Quantitative easing (QE) exposes the fallacies

During a period of 12 years of quantitative easing (QE) combined massive influxes of money into the economy associated with close-to-zero Bank of England (BoE) base interest rates.

Initially there was very little impact on the prices of goods and service. However, with each advance of QE tranches asset prices rose almost in direct proportion to the percentage rise in money volumes associated with each QE tranche.

Where were the price impacts?

Initially, the prices of goods and services remained under the control of companies who set their prices according to unit costs and not money volumes in the economy.

The QTM could not predict these price events because the QTM contains no variables representing asset transactions including:

Land - l;

Domestic and commercial and real estate - r;

Precious metals - p;

Commodities - m;

Art objects - a;

Shares - h;

Financial instruments - f;

Crypto-currencies - c;

As well as the following money states:

Offshore investment - o; Savings - s.

The Real Money Theory (RMT)The Real Money Theory (RMT) was created to replace the QTM with a more realistic identity which includes the variables that represent the missing asset classes, savings and overseas financial flows.

A version of the RMT is presented below:

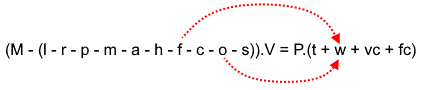

(M - (l - r - p - m - a - h - f - c - o - s)).V = P.Y

Notice that all of these asset classes reduce the circulating funds in M by locking these funds into assets which are exchanged in encapsulated markets. Encapsulated markets involve a significantly reduced proportion of constituents handling high value transactions and a large proportion are not directly associated with supply side production of goods and services. This has the effect of reducing the funds involved in goods and services transactions and investment provoking a decline in productivity and lowering the ability of supply side companies to pay compensatory wages.

The experience with QE was that towards the end of the 12 years period of implementation, the prices of goods and services began to rise. This was again not caused as a response to money volumes in the economy, but rather as a response to the speculative price rises in asset which are also used as inputs and costs for goods and service production or constitute significant cost of living items for constituents. These include all of the assets mentioned but in particular the prices and rentals of land, domestic and commercial real estate, commodities, food, fibre and feed stocks.

Systemic or structural inflation As a result, it is evident that monetary policy in the form of QE ended up creating a systemic or structural inflation.

Extending the RMTVariable inputs

Variable inputs are the production inputs whose quantity varies with the scale of production (throughput). |

|

|

Extensions of the RMT can explain the operation of the systemic inflation created by monetary policy.

Why is this of concern? The interest of the work force as wage-earners and as the consumers in the economy, is that prices of goods and services (housing rents, prices and cost of food and energy etc) remain accessible. On the part of supply side production companies, the concern is with the prices of those particular assets that make up production overheads and variable inputs (see box on right) (land, commercial real estate, commodities and energy) do not rise too fast if at all.

Systemic inflation caused by monetary policy can be analyse by creating

a rough extended function for Y as follows. The Y in the RMT, or the QTM, is essentially total transactions as the disposable income spent on items with an average price of P. Therefore, for illustrative purposes Y can be represented as:

Y = (t + w + vc + fc)

Where Y is total transactions (in simplistic form: worker income = consumption = corporate revenue), t is corporate profit or individual savings, w is work force wages or corporate revenue, vc is consumer variable costs such as essentials or variable inputs for companies and fc is fixed or overhead costs such as domestic rentals or house prices and any fixed equipment durables or commercial mortgage or rentals or prices of commercial properties and capital equipment.

By substituting Y by the

extended function for Y the RMT becomes:

(M - (l - r - p - m - a - h - f - c - o - s)).V = P.(t + w + vc + fc)The result of QE has been to drive up the prices of real estate and land (r) as well as specific commodities (m) such as food and energy products.

Monetary flows driving cost-push inflationAs can be seen these have a direct impact on variable cost items and fixed overheads. The (r) factor relates to the rents and prices of land, apartments and houses, offices, retail units, industrial units and warehouses. The translation of the speculative price rises generated by QE over a decade to primary inflation in goods and services can be seen in the illustrated identity below:

The monetary drain reducing supply side investment and jobs

The monetary drain reducing supply side investment and jobs

Besides draining the purchasing power of money as a result of inflation and economic depression, QE has also resulted in companies buying back their own shares (f) as opposed to investing to increase productivity as well as channelling funds offshore (o) into manufacturing and other ventures that compete with British activities and depress employment. The offshore investment proceeds are often rotated to reinvest and profits held offshore to avoid British corporate taxation leading to lower revenues by the tax authorities.

The combined effect of these elements is to have a direct impact on wages as a result of the opportunity cost of not investing in productivity and channelling funds offshore.

The question of interest rates

The question of interest ratesSo far in this exploration interest rates and fiscal policy were only referred to in the context of M reduction to reduce demand and whether or not the economy returns to an equilibrium position. So far the response to this assertion is to look at the QTM and show there are no "corrective functions" there to explain why the economy would return to some equilibrium. This assertion conveys the impression that an undefined "equilibrium" represents an advantageous state of affairs.

The current state of the UK economy has raised many propositions from monetarists including the Bank of England's intention to continue to raise interest rates to attempt to reduce inflation. This has the same effect as draining funds from the supply side as a result of the disincentive to invest and decline in real incomes of people and companies paying off loans and mortgages.

The question of fiscal policySimilarly combining this with the lower marginal taxes in the upper bands will have a contrary impact. However, based on most previous examples of this tactic, deployed in the UK and the USA, the result has been economic depression, a rise in unemployment and a significant increase in income disparity and a marginal impact on inflation.

ConcludingThe reliance of such identities as the QTM to explain monetary policy can be seen to be a misrepresentation of the mechanisms at work in affecting the economy and such essential factors as real incomes and income disparity. Misrepresentation is perhaps the wrong word because, in general, monetarists do not in fact specify or describe the mechanisms at work but, rather, speak in sweeping and generic terms using such identities as the QTM. This article should have served to demonstrate that the QTM is devoid of any utility for lack of representation of reality and it needs to be removed from the unjustified dominance it has enjoyed for close to a century as a central tenet of monetarism. It should be apparent that the decline and fall of the QTM heralds the decline and fall of monetarism in its current form.

1 Hector McNeill is director of SEEL-Systems Engineering Economics Lab

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2022) unless otherwise indicated