The inevitability of hegemonic cycles - realty of myth?

Part 2

Hector McNeill1

SEEL

This article was first posted on CybaCity.com by Agence Presse Européenne correspondent's Pool workshop on "Essentials" reviewed why hegemonic cycles roll the way they do, ending up in speculative finance; our current state of affairs.

An analysis was presented that explored the question, "Is it possible to maintain the equilibrium between onshore employment, production and wage levels throughout a cycle?" This has always proven to be impossible and the outcome has significant implications for any post-Covid-19 economic policies. Investing in "infrastructure" and "building back better" seem to be empty rhetoric because conventional economic theory contains nothing to support this as a viable proposition.

This article covers the The afternoon session presentation (10th April, 2021).

|

Hegemon: a leader, country, or group that is very strong and powerful and therefore able to control others: |

|

|

BackgroundOne of the most distinctive aspect of the transition from a relatively stable Say Model of the economy which represents an equilibrium between production, wages, investment, productivity and consumption, and the situation towards the end of a hegemonic cycle, is the introduction of a massive increase in injected money into the economy. In RIO (Real Incomes Objective) research and development of theory and policy distinguishes these money flows as:

- Endogenous money - supply side cash flow that supports the Say Model

- Exogenous money - injected money which is largely unconnected to endogenous money

The rate at which technological productivity declines and countries begin to lose their productivity advantages in the production of goods is roughly proportional to the rate of expansion in exogenous money. The correlation between exogenous money volumes and levels of investment in the onshore supply side is negative resulting in lower productivity and lower real wages. A supreme recent medium term case study is the experience of the United Kingdom with quantitative easing.

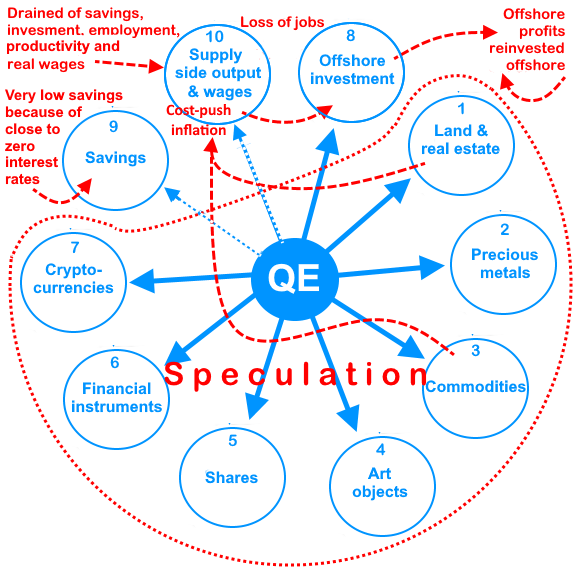

The impact of quantitative easing

Source: McNeill, H. W., "Why monetarism does not work", Charter House Essays in Political Economy, HPC, 2021, ISBN: 978-0-907833-38-3., |

From 2008 through to mid 2020, just 12 years, and before Covid-19 appeared, QE had accelerated the decimation of the supply side production sector in the United Kingdom with the largest growth in exogenous money in the history of the country.

The main outcome was a diversion of investment funds from the supply side production economy into speculative assets. The virtual destruction of savings, because of the next-to-zero interest rates and the diversion of funds into speculative assets while any investment on scale was directed offshore, results in a complete undermining of the Say Model. This is a repeat of the lead up to the 1929 New York Stock Exchange Crash, the slumpflation crisis and the rise in financialization following Nixon abandoning the gold standard and the final jambouree with QE. All of this damage has been the result of policy-induced actions encouraging rising levels of exogenous funding destroying onshore productivity and employment.

It is how economies develop ....The Stages of Economic Growth by Walt Rostow (1916–2003) in 1960

and two generations of economists who have not been informed of the true nature of the Say Model. Indeed in most universities Say is simply not taken seriously by professors who have probably never read Say's work. These economists believe, almost with religious fervour, that "

It is how economies develop. The default and fatalistic position is that hegemonic cycles are a natural consequence of Rostow's final stage of high mass consumption. This is further confused with the so-called comparative advantages of countries to specializing in the production and export of specific products or services.

Back to basicsThe Say Model of the economy is what many consider to be the original concept of capitalism. In the endogenous funding model which does not involve any exogenous funding, entrepreneurs, be they carpenters, bakers of industrialists invest in equipment to use in the production of goods on a reduced scale. With time and acquisition of operational competence people become more skilled in their tasks and produce better quality products. Learning is associated with less waste and increased efficiency and cost saving enabling sales at lower unit prices but higher sales volumes as a result of market penetration. Usually, increased efficiency enables operations to earn sufficient income and even permit some saving at the same time. Therefore the process of saving is often associated with a rising efficiency helping support increased saving. Using savings to invest in extended plant or some innovation would normally be undertaken to increase output associated with increased performance. This growth based on higher productivity can often achieve lower unit costs and unit prices but higher income. Therefore savings generated from endogenous funds are often associated with a state of operations whose efficiency has enabled savings to take place in the first place. So the act of saving can often be a sign of innovation of some kind taking place even before savings are used to invest.

Economic growthThe way in which economic growth occurs in a endogenous funding model is that increased productivity translates into lower unit costs, an ability to lower units prices while securing higher sales volumes. Therefore not only is the real income of the entrepreneur rising so is the purchasing power of their consumers because unit prices are lower. This combination represents real economic growth. In other words the steady impacts of learning and innovation have a deflationary impact on the economy which means the overall value of the currency begins to rise. Under such circumstances savings are in less need of interest paid by banks since the currency is in fact rising in value. As long as the monetary authorities do not raise monetary injections with exogenous money, the economy and the currency can remain in equilibrium associated with real economic growth.

The endogenous funding Say Model characteristicsThe advantages of this Say model are as follows:

- It is not "demand driven" but rather "production innovation driven"

- It is not generally inflationary but is, rather, a deflationary model

- The value of the currency is protected and likely to increase

- Putting money aside without any interest creates an asset whose value rises

- Such funds are liquid meaning they can be used when needed to purchase goods and services at the then going, and likely to be lower, nominal prices

- The real incomes of the whole population will rise steadily

- Even with income disparity the lower income segments constituents will be able to afford basic essentials and increasingly more products and services

How can this be possible? Abraham Maslow Abraham Maslow

1908-1970 |

With many generations not having lived under such an economic regime it sounds like a sort of fantasy. The durability and stability of such a growth model depends upon the maintenance of the innovative state of operation of those engaged in producing basic essentials or needs. Abraham Maslow in his works,

"Motivation and Personality" (1954) and "

Toward a Psychology of Being" (1962), stated that each person faces a series of needs to be satisfied, ranging from basic physiological requirements to love, esteem, and self-actualization. As each need is satisfied, the next level of needs becomes more significant in an emotional motivational hierarchy based on level of dominant motivations. The hierarchy of needs is often represented as a hierarchical pyramid with five levels. The four levels (lower-order needs) are considered physiological needs, while the top level of the pyramid is considered growth needs. The lower level needs must be satisfied before higher-order needs can influence behaviour.

The levels are as follows:

- TOP

- Self-actualization – includes morality, creativity, problem solving, etc.

- Esteem – includes confidence, self-esteem, achievement, respect, etc.

- Belongingness – includes love, friendship, intimacy, family, etc.

- Safety – includes security of environment, employment, resources, health, property, etc.

- Physiological – includes air, food, water, sex, sleep, other factors towards homeostasis, etc.

- BOTTOM

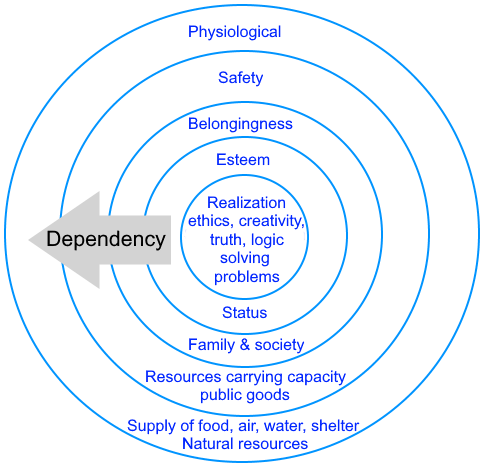

Dependencies and the ability to satisfy needsThe ability to satisfy needs is not a purely psychological issue but rather depends upon the human physical environment, in the end it depends upon the availability of sufficient natural resources. The more significant interpretation of the hierarchy, in the context of economics, is to consider it to be a statement of dependencies in that if the lower level resources that support the satisfaction of needs are not stable and/or are being depleted, then neither can be the higher levels sustain the satisfaction of needs. Therefore, it is productive to imagine the needs and dependencies to be located in concentric bands surrounding society and eventually, each person as illustrated below.

Resource dependencies to support human needs

Source: McNeill, H. W., "Terminating the assault on humanity", RealIncomes.org.uk, February 2021, adapted from several versions of the Maslow hierarchical needs pyramid. |

Notice that on the topic of entrepreneurship and self-actualization, morality, creativity and problem solving this can be considered to function well when the lower level needs are satisfied. Therefore the economy should not operate in a fashion that constrains or prevents the provisions of the goods and services to satisfy these basic needs. The physiological needs being provided for the issues of security including peace of mind are very important and they include engagement in economic activities or occupation. The delivery of this complex array of provisions of satisfy needs depends upon an economy where there is a commonwealth or a shared level of real incomes capable of purchasing what is required as well as a healthy population.

This analysis raises questions of a constitutional order in how constituents order priorities of how decisions are taken on matters which affect everyone and which involve such basic issues that the community conscience in the context of ordering behaviour to fall within expectations of rational behaviour in the interests of all.

To come to resolutions on how to achieve this state of affairs there is no recourse to radical solutions or ideological mantras or 'isms, but rather consideration is being given to how to we as a country can order our affairs to ensure that the basis needs of all are satisfied in order that all can realize a close to universal self-actualization. This is, after all, the foundation of an exercise of a responsible individual freedom and agency operating in a state of contentment and general happiness. These were ultimate higher level objectives of constitutional propositions made by imprisoned Levellers in 1649 and the founding fathers in the USA in 1787.

The underlying purpose of the Levellers' desire, for at least a male suffrage, was to terminate the threat of aggression and violence arising from arbitrary differences. In their opinion this is what gave rise to an unnecessary Civil War. They sought to bring about a state of affairs to reconcile all differences, providing all with a clear conscience whilst preventing the prevalence of interests and private advantages. They sought to prevent any actions driven by malice against anyone or as a result of disagreement over opinions. The objective was peace and prosperity for all. They proposed that the free people of England establish a government without arbitrary power and whose action would be bound and limited by law, so as to remove grievances

Observing the contemporary norms of political discord it is plain that although a country with universal suffrage, today some 370 years later we have a large proportion of the population whose needs have not been met and some of these are the lower order physiological needs including food items. This is a shameful state of affairs and it demonstrates just how ineffective our management of the economy has been in failing to maintain a balance between production, productivity, wages and growth through innovation.

What is the solution?In 1990, a survey carried out for the Manpower Services Commission of 100 high tech companies to determine their interest in establishing an initiative to identify technologies to enable the creation of onshore investments. This was during a period of active globalization, investment in offshore production and loss of employment in the United Kingdom. No company showed any interest. However, applied applications development studies at the Information Technology and Telecommunications Task Force (ITTTF) at the European Commission between 1983 and 1987 established that there were already robotic systems that could place components very effectively in 1988. In other words there was no cost advantage carrying out this work in South East Asia. The failure to bring back mounting activities to the UK and insistence in using very low labour-intensive mounting meant that the UK did not initiate a process of learning. Eventually most production lines in Asia transitioned into fully automatic systems but in the meantime the UK lost a 30 year learning curve advantage on the operation and development and sale of such systems. This is a sign of a complete lack of engineering entrepreneurship of the type identified by Say. The reason this happened was that the engineering entrepreneurship was over-ridden by financial decision making largely based on exogenous funding involving people less directly involved in technology but more concerned with short to medium term financial performance.

In reality state-of-the-art technologies across all economic sectors from agriculture to high tech will have different levels of performance depending upon the operational configuration and human resources experience, competence embedded in tacit knowledge and accumulated explicit knowledge. As a result there are quite significant differences in "practice" for the same state-of-the-art technologies ranging from companies with exceptional performance or "good practice", middling performance or "average practice" and relatively inefficient, "poor practice." The differences in performance between poor and good practice can be extremely high. It is therefore always fruitful to devise ways to transfer know how to those companies operating in poor and average practice bands to help raise their levels of performance into the good practice band. Contrary to common perceptions, the potential for raising national economic productivity is exceptionally high simply on the basis of raising levels of practice based on state-of-the-art technologies. Shifting a whole economic sector into the good practice category can, in some sectors result in excess of 300% gains in productivity. The advantage of this approach is that it entails low risks because what is being sought is demonstrably feasible as demonstrated by those achieving good practice. This transition takes time and is the philosophy adopted by extension systems which have existed in the agricultural sector for well over a century and in what is perceived to be a low productivity sector has achieved a year-on-year increases in productivity since 1945.

Essential supportive factorsBesides extension services there is a need for a fundamental change in basic and higher education towards the introduction of practical technical education, not to replace other aspects of education but rather to provide the whole population of children and students with an exposure to how processes work and to have some practical appreciation through actual hands-on tasks in different technological processes. At a young age this can introduce perceptions and appreciation that enable them to understand better what is required to design and implement novel processes as well as to ask the right questions and follow the productive lines of enquiry when facing a new challenge. Under standing of how to produce "things" also transmits the significance of good organization to sequence tasks and this is something an academic education often lacks. The confusion of individual freedom and organization as being a constraint on freedom is significant misunderstanding of what is needed to defend freedom. Edith Cresson, as a EU Commissioner once commented that the Japanese were successful in consumer electronics goods production because they had an "ant-like mentality", whereas this caused some amusement at the time, it is the lack of such organization in the United Kingdom, for example, that saw serious strategic mishaps associated with the early days of Covid-19, resulting in many more deaths than might have been the case. This was a case study in a "highly educated" prime minister and a cabinet having very little perception of what was required in practical terms to address a national emergency. Their notion of "solving" issues by contracting large companies, whose management has the same educational level, also turned out to be a failure. Those who are down the learning curve and have accumulated a high degree of practical proficiency and tacit knowledge, such as most of the staff of the National Health Service, of course, have performed well in rolling out a faultless vaccination campaign. These comments are not, in any way, "partisan" or "ideology-based" criticisms of individuals in government, but rather a statement of the reality within which we all find ourselves, all having received a general education that is not fit for purpose. On the other hand, practitioners, many of whom do not have higher educational qualifications, have learned their trade to gain a level of tacit knowledge-based competence to do effective and efficient tasks that benefit all.

Time-out!Some aspects of the rest of the afternoon session were such that our correspondents have realized they need assistance to explain what is a somewhat complicated content. Therefore the rest of this article will be added as a 3rd part of this series. In reviewing the workshop content the APEurope Pool economists came to the following conclusion:

- The logic of what was presented in the workshop, although seemingly correct is extremely counter-intuitive, especially for conventional economists

- This relates to the gaps in the content of the majority of conventional economics university curricula taught during the last 50 years

- The policy proposals are fundamentally different from any current or past policies

- These proposals cannot be tested against conventional macroeconomic theory in the form of Keynesianism or monetarism because these macroeconomic schools of thought contain no reference to the concepts involved

- On the other hand the logic aligns with microeconomic logic in a self-evident fashion

- This microeconomics test reaffirms that significant gaps exist in conventional macroeconomic theory as represented by Keynesianism and Monetarism

APEurope Pool has therefore organized an additional workshop to be held Wednesday, 14th April 2021 afternoon with an evening session in case needed, to assist in clarifying correspondent's questions so as to help them prepare draft article that conveys the concepts involved on the basis of a credible logic, transparent analysis and communications clarity. The Pool's role is limited to answering correspondent's questions while correspondents remain free prepare their own content. We expect to post the third article in the next day or so.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2021) unless otherwise indicated