A constitutional economic policy - Part 2

Hector McNeill1

SEEL

In Part 1 of this series I outlined the three basic concepts in support of a constitutional economic foundation for RIO. These included: basic meaning of constitutional economics, its support of freedom of individual action and the relationship between real incomes and this freedom for individual action.

In this second part I review the issue of opportunities for people to take advantage of their relative freedoms and constraints that frustrate access or ability to take advantage of opportunities, many of which have been created by economic policy frameworks.

|

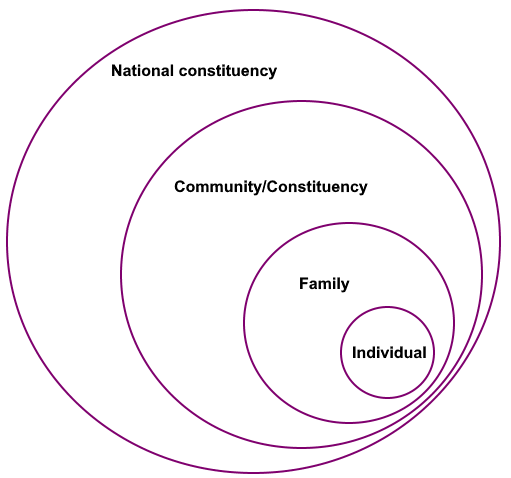

Constitutional orderConstitutional order is where a society adheres to the principle of equality of all persons before the law and therefore in the process of establishment of laws, regulations and policies, account is taken of individual expectations under this principle.

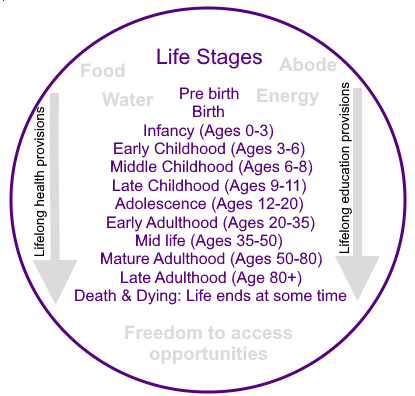

OpportunitiesBased on the circumstances of family each person starts out in life with quite different abilities to take advantage of opportunities for them to satisfy preferences, including individual pursuits and livelihoods. Some basic requirements include a balanced education in the sense of exposure to the wide range of cultural history and social norms of society as well as an understanding and ability to make use of literacy, numeracy, mathematics, science, technology and literature.

Individuals enter the world with a specific genetic make up and dietary habits largely based on their childhood experience and family habits. Dietary habits can, of course, be changed when individuals feel a need related to health or basic fitness, or they have been exposed to new foods which have entered their list of preferences.

It is self-evident that health, access to a balanced diet including water, shelter and clothes make up a list of basic needs for each individual. Since few people are in a position to grow their own food, spin yarn and end up weaving textiles to make clothes or even build a house, all of these provisions need to be accessed by spending real income on these items.

Returning to Robert Owen's 1827 proposal that "workers" need a balance between time spent working, in recreation and rest as

"8 hours labour, 8 hours recreation, 8 hours rest" we return to the subject of how individuals use their "free" time to take advantage of opportunities to advance their personal objectives and desires. Here we need to look at the production, accessibility and consumption model (PACM) because for people to be able to take advantage of opportunities they need three states of accessibility:

- access to information and knowledge on opportunities of interest to the individual

- unit prices accessible in terms of affordability according to an individual's disposable real income, if taking advantage of the opportunity requires payment of money

- access to permanent availability of relevant opportunities where a person is and will remain

|

Baseline provisions to maximize opportunitiesIn order for an individual to have a maximized ability to take advantage of opportunities free from constraints it is self-evident that the following conditions need to be satisfied:

- Good health and continuing life-long health support

- Good basic education and continuing life long educational support

- Access to a balanced diet including water

- Energy sources

- An abode

- Clothes

The first two concerning health and good basic education remain a "maintenance" function so that people through their life stages have access to appropriate health and deduction/training provisions.

Without at this stage looking at how these provisions should be made available and what this has to do with policy it is relevant to focus on individuals as employees or wage earners as opposed to individuals with a command over how they make use of their recreational and rest time assignments.

Corporate environmentsCompanies are created for many different reasons but in the main their evolution has caused a migration towards them being sources of income and profits for those to set them up as well as for shareholders who have provided cash as equity and shareholders who have purchased shares in the cases where companies have publicly traded shares. Individuals become employees of companies, also with the basic motivation of earning an income. In terms of constitutional economics there is no distinction made between the citizens or individuals who are company owners, shareholders or employees. The principle of no single individual's goals or values can supersede the value of another's, remains in force. Therefore the particular rules that apply to an employment contract would set out conditions which should not conflict with laws, regulations and policies. In the case of RIO it is assumed that the legal and regulatory environment adheres to the principle of no single individual's goals or values supersede the value of another's, and therefore employment contracts need to comply with this stipulation.

Variance in incomes"Entrepreneurs", corporate owners and shareholders will invest time, effort and funds in the hope that a business will grow. As a result of this is the parallel hope that incomes earned from their investment will also grow. This is considered to be a justifiable and fair basis for compensation. However, government revenue-seeking is applied to the corporate sector in the form of corporate taxation. The process of estimating tax liabilities is through the process of creating accounts, usually on an annual basis. The accounting norms place wages paid to employees, as a cost item along with component variable inputs, energy and other costs.

The submission for accounts for the determination of tax liabilities is a process enforceable through legal processes. It is therefore immediately apparent that the goals and values of owners and shareholders as citizens are not treated in the same way as employees. This becomes more obvious when it comes to resource assignment decisions in the normal process of corporate decision making and planning. Since there is no over-riding legal principle that no single individual's goals or values can supersede the value of another's, citizens who are employees do not have a basis for demanding the same variance in incomes linked to corporate growth, as owners and shareholders. As a result, there is no incentive for corporate owners and shareholders to compensate employees for their joint contribution to a company's growth. In this common scenario, the work force becomes a commodity like the rest of the resources on the cost side of the corporate accounts ledger. As a result, worker compensation lies in a domain of arbitrariness as a direct result of the constitutional anarchy created by the practice of government revenue-seeking based on corporate taxation and the corporate accounting code. The ultimate affront to the majority of constituents who and employees on a wage earning basis is that this marginalization and isolation occurs within the bounds of the existing laws; it is legal.

One of the secondary effects of this state of affairs is that employers have no incentive to respond to requests for higher wages because their response is that people can always leave the job if they are not satisfied with their pay. The situation in the economy is such that they know that it will not be difficult to find others to fill the places of those who have left. This, in a weak economy, for the wage earning majority is a reality but it is a confirmation of the absence of a constitutional economy.

The opportunity cost of not having a constitutional economyDuring the last 30 years wages as a percentage of national output has declined and profits as a percentage of national output have risen.

In the shadow of quantitative easingUnder quantitative easing wages have declined even further as large inflows of money have been diverted away from essential productivity enhancing investment and into non-circulating assets such as land, real estate, precious metals and corporate shares (see A Real Money Theory ). This diversion has been driven by banks and large corporations who have used low interest loans to buy back their shares creating a significant inflationary bubble. The executives who are charged with such decisions are paid through bonuses which vary according to the rise in share prices. As a result these individuals can end up receiving in excess of £ million as annual bonuses. The shareholders who favour this fraudulent

2 process of driving share prices upwards support this high bonus payment to executives because they themselves are benefiting.

Relative real incomesIn terms of the balance of opportunities of goals and values of citizens being handled on a equitable basis it is instructive to analyse the impacts of this state of affairs on real incomes. Wage earners remain in a situation of erosion in real value of wages paid. On the other hand asset holders can rent land and real estate and can deal in shares and precious metals and other assets which rather than falling in value are rising at very high rates, less as a result of intelligent "dealing" but as a direct outcome of policies that have created disincentives for companies to raise wages and incentives for a small minority of citizens to benefit directly from flow of funds in their direction.

EfficiencyA function of constitutional economic analysis of to determine if an existing legislation, regulation or policy is efficient in terms of the fundamental principles of equality of treatment of citizens in relation to their freedom and access to opportunities. With the majority of the constituents in the United Kingdom being wage earners it is self-evident that the state of affairs described represents one in which a small minority of the constituency is a direct beneficiary of law, regulations and policies in terms of their freedom and access to opportunities. They have the freedom to take advantage of the opportunities laid before them by policies such as quantitative easing while the rest of the electorate is unable to benefit but are expected by the government to endure declining real wages.

Since the majority of consumers are wage earners and they receive their incomes from goods and service production activities (endogenous to the supply side) it makes economic sense to adjust wages upwards and invest in productivity enhancing technologies and organizational changes to do so in a profitable fashion. In this way nominal incomes of wage earners can rise and if price setting has been adjusted to productivity increases in a competitive fashion, this can result in a rise in consumption, as a result of the price elasticity of consumption, leading to real economic growth. The aggregate demand model (ADM) ignores endogenous money because stable consumption is often equated with "deficit demand" and as a result "exogenous" money is poured into the economy such as in the case of quantitative easing. Quantitative easing is a policy constructed as a result of a constitutional anarchy guided by the interests of the financial services companies who only deal in "exogenous" money. Needless to say, the option of raising wages and productivity was so counter-intuitive to people whose business is purely financial, this realistic option was not even considered. Rather this option was confused for "helicopter money" of "QE for the people". The difference between exogenous money-based QE and endogenous money-based wage increases linked to higher productivity is that the endogenous case requires that companies themselves manage the process of wage rises and investment in higher productivity processes to carry the increased wages resulting in higher consumption and economic growth. In the case of "QE for banks" or "QE for the people" all that happens is the creation of irrational debt which it not linked to evidence-based applications whose productivity can pay back the debt; it is a dead end logic. As a result of such constitutional anarchy on the part of government's biased decision-making we have not has any economic growth, just a massive growth in the incomes of a minority of constituents. In terms of efficiency the absence of a constitutional framework for decision analysis on macroeconomic policy has resulted in a disaster.

Peering through the unconvincing explanations attempting to justify quantitative easing that adorn the Bank of England website with various slick videos, it is possible to detect a complete lack of constitutional logic in relation to the needs of the majority of individuals in this country and a lack of any sense of the importance of individual freedom and opportunities for the population. It would be unfair to accuse those who put out such propaganda as acting in support of a tyranny because they might even believe their own output, but this decision-making process which, as explained, is a constitutional anarchy where government policy has been commandeered by a small group of people who seem to have unlimited power over the people in this country and use it unfairly; this is the definition of tyranny.

The next article in this series will explain how RIO policies can establish a constitutional economy that promotes greater real incomes, freedom and opportunities for the majority in such as way that the whole economy can move onto a more efficient basis.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

2 Share prices were normally considered to reflect the likelihood of rises or stability in dividen payments related to the price-earnings ratio statistics. Investors would keep an eye out for market information about companies to gain insights as to who was investing in improved systems in response to market conditions. Following a relaxation in financial regulations, what used to be an illegal act, has become a widespread phenomenon as share buy backs which simply turn shares into a commodities traded on a speculative basis. Announcements of buy backs tend to raise share values leading to a rush to buy thereby raising prices yet higher. This manipulation of share prices is fraudulent because share prices no longer reflect the fundamentals of company operations. Share buy backs has become widespread under quantiative easing with over 50% of share price gains being linked to share buy backs, much based on low interest loans or centrsl bank asset purchases. However, the fundamentals of these companies in terms of performance have not changed, in fact in many cases investment and productivity have fallen. As a result the "market performance" has no relationship to the state of the economy.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2020) unless otherwise indicated