|

The Real Incomes Approach

A new paradigm

Introduction

The Real Incomes Approach is a new economic paradigm that is finding increasing relevance to the management of all types of economy and states of economy. The Real Incomes Approach is the result of development work initiated in 1975 by the British economist Hector McNeill. The approach was, like supply side economics, originally designed to tackle slumpflation through counter-inflationary growth. However, further investigation has established that it is a universally applicable policy for all conditions of the economy.

Keynesianism, monetarism and supply side economics (KM policies) all impose conditions that generate differentials between the social and economic constituents generating winners, losers and those unaffected by policy.

The Real Incomes Approach to economics is the only macroeconomics approach that has microeconomic foundations and which provides a simultaneous support for corporate innovation, compensatory wages and moderated consumer prices including interest rates. It provides a more practical basis for sustaining growth in real incomes while achieving a better income distribution to prevent marginalization of any group under conditions of any state of the economy.

What is the problem that the Real Incomes Approach to Economics solves?

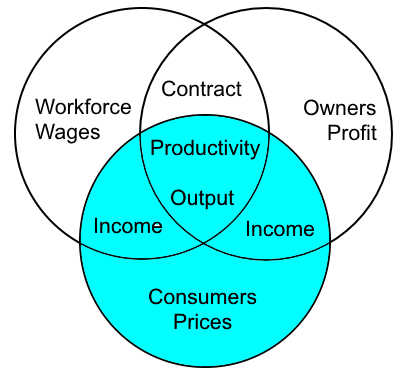

The Venn diagram on the left is a simple representation of inter-relationship between economic units, workforces and consumers. Although KM economists assume that the solution to slumpflation (recession: high unemployment, high inflation, stagnating wages, rising cost of living ) and to deflationary recession (low inflation, low unemployment, stagnating wages, rising cost of living) are different when in reality they both represent a single state of affairs. This is the common state of arrested or falling real incomes. The key issue is that no matter what state the economy is in terms of indicators such as unemployment, inflation, wage growth and the cost of living the most important policy performance indicator is the state of real incomes. This is a comprehensive indicator which can be used to manage the direction of travel required of:

- inflation

- cost of living index

- employment levels

- wages

|

- income distribution

- profits

- exchange rates

- interest rates

|

- taxation

- money volume

- unit prices

- economic growth

|

- exports

- imports

- import substitution

- reserves

|

As we all know, KM policies select some of these listed factors as indicators while ignoring the others. These policies also attempt to selectively influence their state. So that when those factors or indicators that have been ignored, become an issue for concern, policy switches to try and compensate. This creates the well-known instability and cycles associated with KM policies.  Lowering the cost of living Lowering the cost of living |

Why is the Real Incomes Approach different? All generations with a clear conscience and mutual respect All generations with a clear conscience and mutual respect |

The instability caused by KM policies requiring an uncoordinated sequencing of attempts to change the values of a long list of indicators is caused by a failure to recognise the significance of a "short cut" in the form of the single indicator of real incomes. Real incomes has just two determinants or controlling factors. These are productivity and price performance ratios (PPR). Productivity growth provides firms with the freedom to change the relationship between input prices and output prices, revenues and competitivity. The critical factor here is that real incomes are therefore determined by the supply side actions of the setting of output prices against input costs and the level of revenue desired. The more competitive the output prices the greater is the transfer of real income to consumers, achieved by lower prices augmenting the purchasing power of a given nominal income. The Real Incomes Approach to Economics proposes a Price Performance Policy (PPP) that uses policy instruments to provide incentive for workforces and corporate ownership and shareholders to concentrate on physical productivity and management of the price performance ratios so as to balance the real income of consumers, related to prices, against the real incomes of workers and shareholders so as to achieve a balanced augmentation in real economic growth and a more equitable distribution of income. In contrast the Real Incomes Approach is specifically designed to achieve a positive systemic consistency through policies that:

- remove the systemic failures created by the profit paradox

- are more effective than conventional supply side economics in generating growth and employment

- are more effective in currency value management and elimination of inflation than conventional monetary policy

- are more effective in increasing the efficiency of operation of fiscal policy and public services

- provide a direct and sustained incentive for investment in technology and human resources

|

The main outcomes

- increasing productivity

- sustained reduction in inflation

- sustained growth in real incomes

- effective distribution of real incomes through all income categories

- increased employment (reduction in unemployment)

- public services cost less and deliver more

|

Notable aspects of the policyReal Incomes Policies such as Price Performance Policy are quite distinct from conventional policies and the following are some of the key differences:

- No corporation tax

- A Price Performance Levy is paid by companies according to price performance

- Managers can allocate resources in response to exogenous input price rises to improve price performance and reduce the Levy, even to zero

- Corporate performance is based on the generation of income of personnel (ownership, shareholders, managers and employees) against investment

- Improvements in price performance are compensated by Price Performance Levy discounts that are treated as bonuses, paid pro rata to all people associated with the company

- Public services are subject to the same incentive regime as private sector

- Where Levies are paid, these do not count towards government revenue, but are reserved for the future use exclusively in investment in technology and human resources by the company

- Government revenues are raised exclusively from personal income tax

|

Relevance

The overall relevance of the Real Incomes Approach is that it is sufficiently generic in application and yet able to respond to the specific needs of all economic and social constituents so as to provide effective growth conditions for:

Assisting families to become Assisting families to become

self-reliant in

transition economies |

Turning aid into sustainable development Turning aid into sustainable development |

- countries facing sovereign debt, government deficits and/or high levels of private debt

- removing the need for "austerity policies"

- developing effective economic management in countries in transition

- improving productivity and assisting onshore developments in developed economies

- helping reduce regional or national differentiations within currency unions

|

Substituting austerity with positive growth in real incomes Substituting austerity with positive growth in real incomes |

All content on this site is subject to Copyright

All Copyright is held by © Hector Wetherell McNeill (1975-2015) unless otherwise indicated

|